Get Help On Your Medicare Journey With Our Comprehensive eBooks

Help with Medicare: Your Essential Guides

As you approach the milestone of turning 65 or you are currently navigating the complexities of Medicare, it’s crucial to have reliable resources to guide you. It’s not uncommon whatsoever for any senior in any part of the country with any particular health profile to reach out for help with Medicare. My Senior Health Plan is proud to offer three comprehensive eBooks designed to empower you with the knowledge needed to make informed decisions about your healthcare coverage. Whether you’re a new beneficiary, a current enrollee, or a caregiver, these resources are invaluable.

Why Choose Our Resources?

Our eBooks are excellent resources for anyone turning 65, beneficiaries already enrolled in Medicare, and caregivers making decisions on behalf of another Medicare beneficiary. Empower yourself with the knowledge to navigate Medicare confidently and ensure you make the best decisions for your healthcare coverage.

At My Senior Health Plan, we are dedicated to simplifying Medicare complexities and providing you with trusted advice and support. Explore our eBooks and take the first step towards a more informed and empowered Medicare journey.

For personalized guidance and support, don’t hesitate to reach out to our expert team. We’re here to help you every step of the way.

eBook #1 – Medicare 101: Understanding the Basics

Navigating the Medicare landscape can often feel like traversing a maze of choices, plans, and regulations. Our eBook, “Medicare 101: Understanding the Basics,” is designed to illuminate the complexities of Medicare, making it accessible and manageable for everyone. This invaluable resource is tailored for anyone looking to demystify Medicare’s complexities, whether you’re turning 65 for the first time and newly eligible, considering a plan change, or seeking a deeper understanding of your existing coverage and strategies to help with Medicare and maximize your benefits.

What You’ll Learn

- Foundations and Beyond: Understand the essentials of Medicare Parts A & B, their costs, and coverage, and receive guidance on selecting the plan that’s right for you—whether you’re enrolling for the first time or reconsidering your current plan.

- Strategic Enrollment: Delve into enrollment periods, learn how to navigate them whether you’re enrolling for the first time or looking to make changes, and compare Medicare to your employer’s plan.

- Plan Optimization: Explore the variety of plans available in your area, including Medicare Advantage (Part C), Prescription Drug Plans (Part D), and Medicare Supplement Plans (Medigap), with insights into tailoring these plans to suit your healthcare needs better.

Comprehensive Understanding:

Gain valuable insights into all facets of Medicare, from initial enrollment to optimizing your current plan.

Empowerment:

Equip yourself with the knowledge to make informed decisions, ensuring your healthcare meets your needs at every life stage.

Personalization:

Discover how to customize or modify your Medicare coverage for maximum benefit and peace of mind.

Expert Guidance:

Learn from the experiences of others in the Medicare community and have your questions answered by experts.

eBook #2 – The Top 10 Medicare FAQs: Empowering Your Medicare Journey

Help with Medicare: Your Guide to the Most Common Questions

To further support your Medicare journey, we present “The Top 10 Medicare FAQs: Empowering Your Medicare Journey.” This eBook addresses the most frequently asked questions about Medicare, offering clear, expert guidance to enhance your understanding and management of the program’s benefits. It’s about making informed decisions that ensure your healthcare coverage meets your needs at every stage.

Key Topics Covered

- Medicare Parts Overview: What are the different parts of Medicare, and what do they cover?

- Enrollment Guidance: How do I enroll in Medicare, and when are the enrollment periods?

- Coverage Beyond Basic Medicare: Does Medicare cover prescription drugs, dental, vision, and hearing aids?

- Choosing Between Medicare Advantage and Original Medicare: What is Medicare Advantage, and how does it differ from Original Medicare?

- Understanding Medicare Costs: How much does Medicare cost? Are there premiums, deductibles, and copays?

- Keeping Your Current Healthcare Providers: Can I keep my current doctor with Medicare?

- Supplementing Medicare with Medigap: What are Medicare Supplement Plans (Medigap), and how do they work?

- Exclusions from Medicare Coverage: What is not covered by Medicare?

- Coordinating Medicare with Other Insurance: How does Medicare work with other insurance I might have?

- Assistance for Low-Income Beneficiaries: How can I get help with Medicare costs if I have limited income and resources?

Empower Your Decisions:

Navigate Medicare with confidence and ensure your healthcare needs are met comprehensively.

Expert Insights:

Seeking help with Medicare by leveraging the knowledge of experts helps you make the most informed choices about your coverage.

Enhanced Understanding:

Get answers to the most pressing Medicare questions to optimize your benefits.

Proactive Management:

Stay ahead of potential issues and ensure your Medicare plan adapts to your changing healthcare needs.

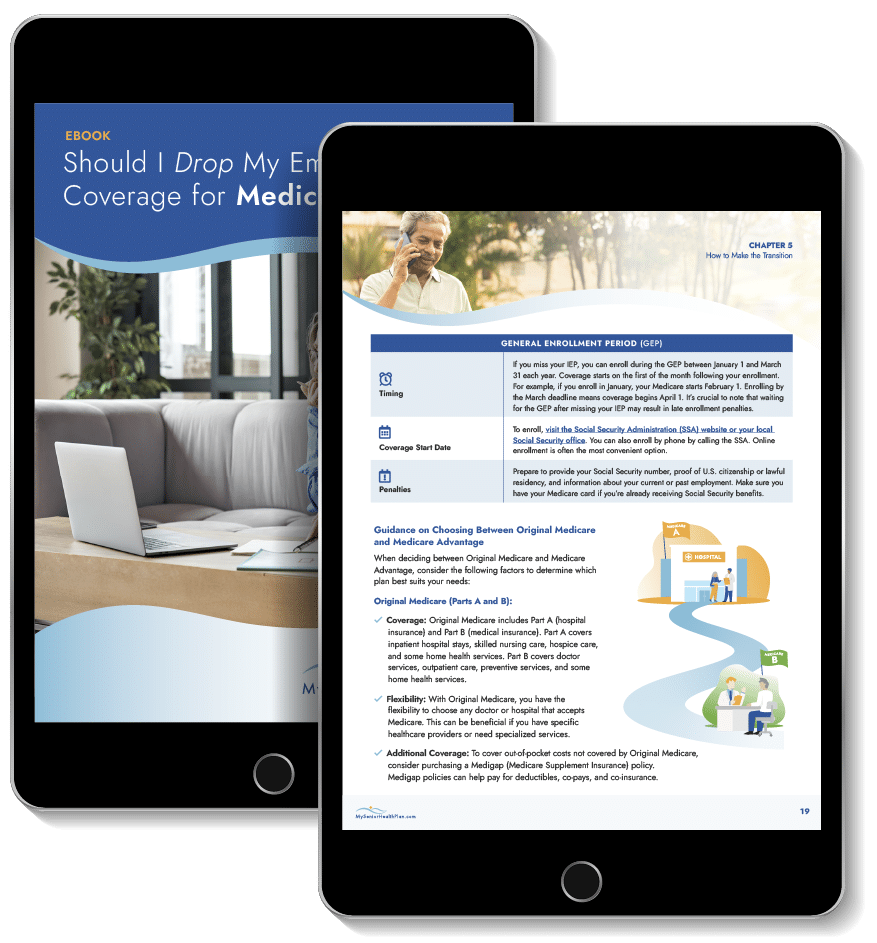

eBook #3 – Should I Drop My Employer Coverage for Medicare?

As more seniors continue to work beyond the age of 65, navigating Medicare alongside employer-sponsored health coverage becomes a critical consideration. If you’re unsure about whether to drop your employer health insurance for Medicare, our comprehensive new eBook, Should I Drop My Employer Coverage for Medicare?, is here to help with Medicare decisions that affect your coverage and finances.

What You’ll Learn

This easy-to-read guide walks you through the essential factors to consider, such as:

- Comparing the costs and benefits of Medicare vs. employer coverage

- Evaluating special considerations, like Health Savings Accounts (HSAs) and coordination of benefits

- Common scenarios seniors face when deciding whether to keep employer health insurance or enroll in Medicare

- A carefully curated list of Frequently Asked Questions (FAQs) addressing the most popular questions seniors have that are faced with this decision.

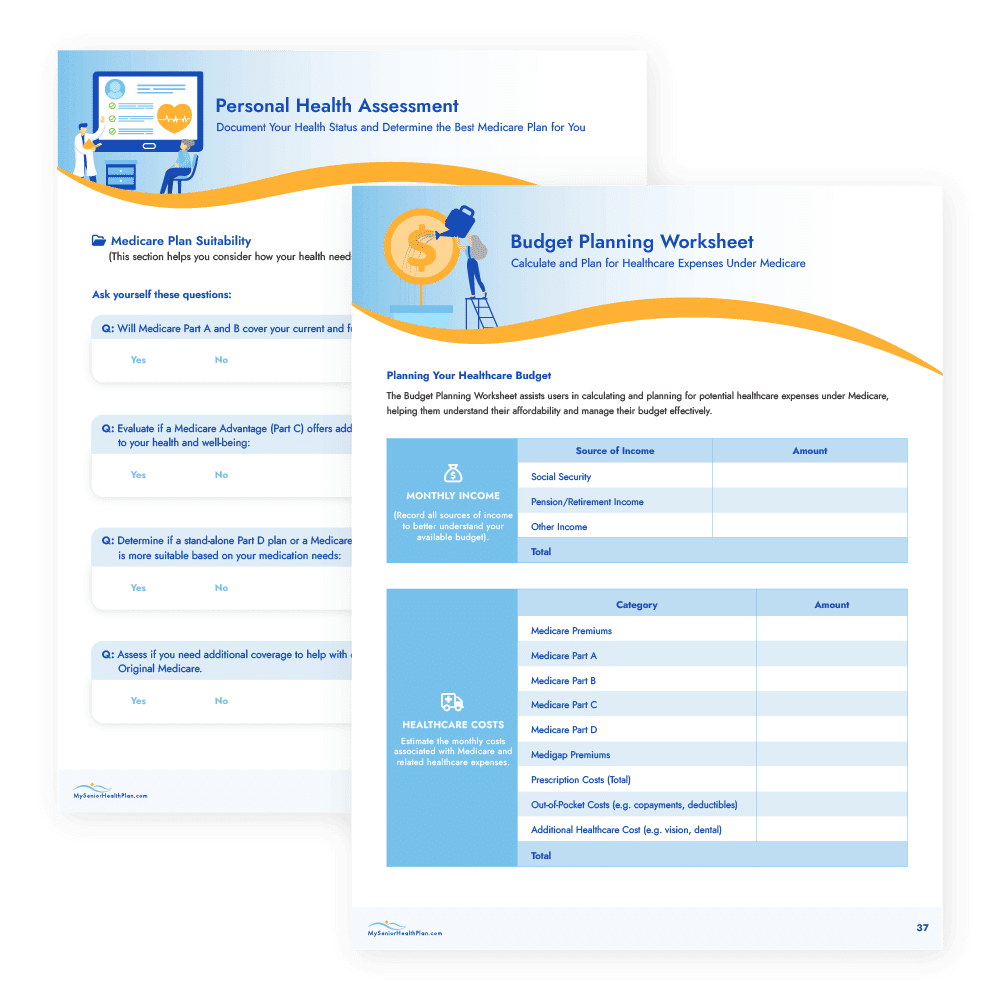

Interactive Worksheets Included!

At the end of the eBook, you’ll find practical worksheets designed to help you assess your personal situation. These tools allow you to evaluate your current health coverage, calculate potential costs, and make an informed decision about your healthcare moving forward.

Why Download this eBook now?

With Medicare’s Annual Enrollment Period fast approaching (October 14 – December 7), now is the perfect time to explore your options and ensure you’re making the best decision for your healthcare needs. This eBook simplifies a complex process, giving you actionable insights to navigate your options confidently.