Basic Medicare Plans & Coverage

What is Basic Medicare?

When it comes to Medicare 101: Understanding the Basics, it’s important to remember that confusion about this government program could be detrimental to your health and your wallet. Rest assured that if you are confused about Medicare’s coverage and costs, you are not alone. Medicare is a health insurance initiative backed by the US federal government designed to provide coverage to different segments of the population, including individuals who are 65 years old and above, people under 65 with disabilities, individuals diagnosed with amyotrophic lateral sclerosis (ALS), and those with end-stage renal disease (ESRD).

Medicare 101: Understanding the Basics:

Part A and Part B. Medicare Part A Plans primarily cover hospital stays, skilled nursing facility care, hospice care, and limited home health services. Medicare Part B covers medical services like doctor visits, outpatient care, preventive services, and some medical supplies. While Part A is generally premium-free for most beneficiaries, Medicare Part B Plans require a monthly premium. Medicare beneficiaries have the option to add supplemental coverage through private insurance plans, known as Medicare Advantage (Part C), or prescription drug coverage through a Medicare Part D Plan.

Medicare is divided into several parts:

Medicare Part A Coverage – also known as Hospital insurance, provides comprehensive coverage for various healthcare services. These plans typically cover in-patient hospital care, limited in-patient skilled nursing facility care, certain home health care, and hospice care. Notably, individuals with 40 or more quarters of Social Security credits (equivalent to around 10 years of full-time work) who qualify for Social Security or Railroad Retirement benefits are exempt from paying a monthly premium for their Medicare Part A Plans, and many beneficiaries need the savings!

Medicare Part B Coverage – provides coverage for outpatient medical services. These plans help cover a portion of the Medicare-approved costs associated with various out-patient medical services. This includes doctors’ services, out-patient hospital care, laboratory tests, out-patient physical and speech therapy, ambulance services, certain medical equipment and supplies, as well as some home health care in San Diego. Medicare Part B Plan premium amounts may vary depending on different factors such as income and the year.

Medicare Part C Coverage– Medicare Advantage Plans

Medicare Part D Coverage – Prescription Drug Plans

How to Find Out What Original Medicare Covers:

If your provider believes that Medicare might not cover something that is typically included, you will be asked to read and sign a notice stating that you may need to pay for the item, service, or supply. Consult a My Senior Health Plan experienced advisor for guidance if you have questions or need additional information.

Medicare.gov publishes an official Medicare guide called “Medicare and You” which is also a great resource. There you can find lists of basic Medicare plans and coverage for seniors.

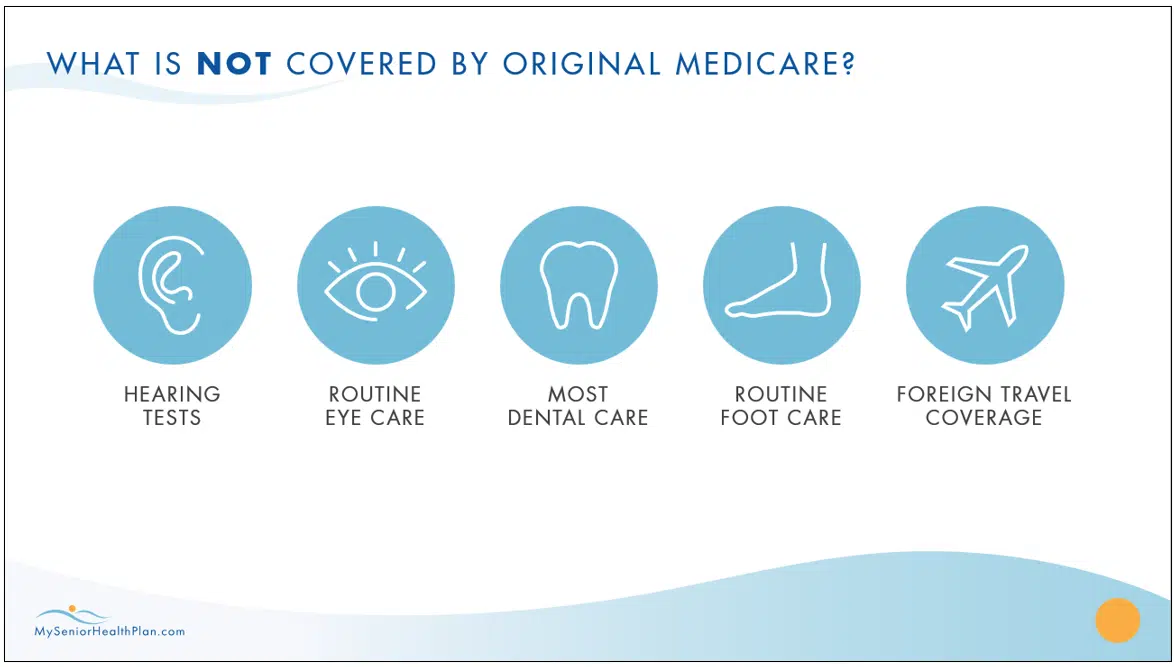

Not everything is covered by Medicare. If you require particular services that aren’t covered by Medicare, you’ll need to pay for them on your own, unless you have other insurance or you’re enrolled in a Medicare health plan that includes these services.

Medicare doesn’t cover certain things like:

- Long-term care

- Most dental care

- Eye examinations related to prescribing glasses

- Dentures

- Cosmetic surgery

- Acupuncture (as a treatment for lower back pain)

- Hearing aids and exams for fitting them

- Routine foot care

When Medicare does cover something, you usually have to pay for your deductible, coinsurance, and copayments.